Accumulation distribution indicator: Accumulation Distribution Indicator A D Overview, Formula

First, a multiplier is calculated based on the relationship of the close to the high-low range. Second, the Money Flow Multiplier is multiplied by the period’s volume to come up with a Money Flow Volume. A running total of the Money Flow Volume forms the Accumulation Distribution Line. Chartists can use this indicator to affirm a security’s underlying trend or anticipate reversals when the indicator diverges from the security price. The indicator is designed to assess, whether the stock is being accumulated or distributed, i.e. whether traders are actually buying or selling it.

An A/D line’s move higher is a signal that buying pressure is starting to prevail. On the flip side, an A/D line’s downward move signals increased selling pressure is beginning to gain a foothold. While their initials might be the same, these are entirely different indicators, as are their users. The price oscillates throughout the day and finishes in the upper portion of its daily range, but is still down 18% from the prior close.

The A/D line is used to help assess price trends and potentially spot forthcoming reversals. If a security’s price is in a downtrend while the A/D line is in an uptrend, then the indicator shows there may be buying pressure and the security’s price may reverse to the upside. Conversely, if a security’s price is in an uptrend while the A/D line is in a downtrend, then the indicator shows there may be selling pressure, or higher distribution. It often works better together with other effective technical indicators, including the Money Flow Index and the Relative Strength Index . Step 3 – The A/D line is calculated by adding the previous ADL with the current period’s money flow volume. As such, the A/D will always fluctuate between +1 and -1.

The Accumulation Distribution Line is a cumulative measure of each period’s volume flow, or money flow. A high positive multiplier combined with high volume shows strong buying pressure that pushes the indicator higher. Conversely, a low negative number combined with high volume reflects strong selling pressure that pushes the indicator lower. Money Flow Volume accumulates to form a line that either confirms or contradicts the underlying price trend. In this regard, the indicator is used to either reinforce the underlying trend or cast doubts on its sustainability.

Bullish and Bearish Signals

The Accumulation Distribution Line and On Balance Volume are cumulative volume-based indicators that sometimes move in opposite directions because their basic formulas are different. Joe Granville developed On Balance Volume as a cumulative measure of positive and negative volume flow. OBV adds a period’s total volume when the close is up and subtracts it when the close is down. A cumulative total of this positive and negative volume flow forms the OBV line. This line can then be compared with the price chart of the underlying security to look for divergences or confirmation.

You then subtract the two results and divide it with the high minus low. There are hundreds of indicators, put into several categories, available in most trading platforms. There are trend indicators like the Parabolic SAR and oscillators like the relative strength index . These indicators are used to show whether there is a trend while oscillators are used to identify key levels such as overbought and oversold.

Indeed, as shown below, the two indicators look alike when they are applied in a chart. Finally, you should buy when the A/D indicator is moving higher and sell when it is moving lower. There are three steps to calculating the Accumulation Distribution Line . Second, multiply this value by volume to find the Money Flow Volume. Third, create a running total of Money Flow Volume to form the Accumulation Distribution Line .

Disconnect with Prices

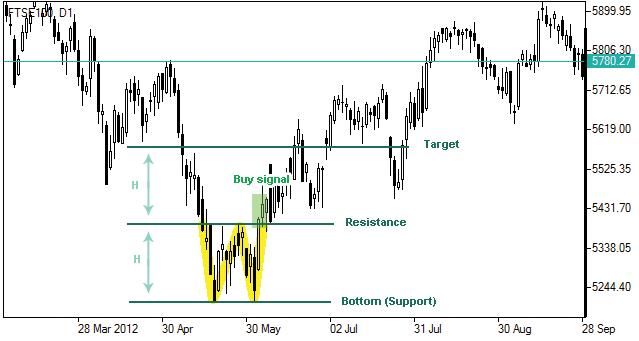

It helps determine future stock price movements and hence provides an edge. Bullish signals occur when the price of a security is moving downward or is in a downtrend, but A/D line trends upward . This divergence signals increased buying pressure, which can indicate weakening seller strength. It is usually followed by a change in the trend of the security from downward to upward. The money flow index is a volume-weighted momentum indicatorcalculated using a 14-day period.

The Accumulation Distribution Line only looks at the level of the close relative to the high-low range for a given period . The AD line ignores the change from one period to the next. Minor Changes – Sometimes it can be difficult to detect minor changes in volume flows. The rate of change in a downtrend could be slowing, but this would be difficult to detect until the A/D line turned upward. Repeat the process as each period ends, adding/subtracting the new money flow volume to/from the prior total.

Since the A/D line ties with the price movements for a period, it can cause a disconnect between the stock price and the indicator. The multiplier in the calculation provides a gauge for how strong the buying or selling was during a particular period. It does this by determining whether the price closed in the upper or lower portion of its range. Therefore, when a stock closes near the high of the period’s range and has high volume, it will result in a large A/D jump.

Indicators Q ~ U

The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. A value of 1 indicates that the close is equal to the low of the range. DTTW™ is proud to be the lead sponsor of TraderTV.LIVE™, the fastest-growing day trading channel on YouTube. The A/D indicator is often confused with the OBV indicator.

A bearish divergence happens when the asset’s price creates higher tops on the chart, while the indicator is giving lower tops. In case of a bearish divergence, the security tends to make a rapid bearish movement. The bullish divergence works the same way, but in the opposite direction. Traders can use this indicator to prove a stock’s trend or anticipate future price reversals. The accumulation/distribution is one of the most common technical indicators in the market.

Trading Gaps – The A/D line does not take trading gaps into consideration so these gaps, when they occur, may not be factored into the A/D line at all. Therefore, if a stock’s price has gapped upward but closes around the midpoint, that gap will be ignored because the A/D line is formulated using closing prices. Monitor General Money Flow – The A/D line can be used as a gauge for the general flow of money.

Chartists can also add a moving average to the indicator by using the advanced options. Click here for a live chart with the Accumulation Distribution Line. When the stock price and A/D indicator both make low peaks and low troughs, the downward trend is likely to continue.

The A/D indicator is cumulative, meaning one period’s value is added or subtracted from the last. The Accumulation Distribution Index is calculated as a cumulative total of each day’s reading. Indicator Panel provides directions on how to set up an indicator.Edit Indicator Settings to change the default settings.

Cory is an expert on stock, forex and futures price action trading strategies. However, another important feature of the ADL indicator is divergence. It happens when the ADL line contradicts the price movement, providing a bullish or bearish signal. The Money Flow Multiplier also known as close location value usually fluctuates between +1 and 1. It compares the closing price for a certain period to the range over that period.

It was developed by Mark Chaikin, who is also known for developing the Chaikin Oscillator. In this article, we will look at the accumulation and distribution indicator and how it works to find out the strength of a trend. For a given period, if the A/D indicator is falling, then distribution may be higher and is a sign of the future downward breakout. When price continues to make lower troughs and Accumulation Distribution fails to make lower troughs, the down trend is likely to stall or fail. When price continues to make higher peaks and Accumulation Distribution fails to make higher peak, the up trend is likely to stall or fail.

Since the accumulation distribution indicator is a cumulative measure, the previous A/D value is added to the current period’s money flow volume to get the current A/D value. The money flow volume, combined with the previous A/D value, confirms the current price trend and helps predict the sustainability of the current trend. Financial writer Joe Granville developed on-balance volume to measure the cumulative volume flow of a stock. Both the A/D indicator and OBV are volume-based indicators but with different approaches. OBV adds a period’s total volume if the stock closes at a higher price than the previous close and subtracts if it closes at a lower price. The total of the positive-negative volume flow forms the OBV line, which is used as a comparison indicator of confirmation or divergence for the stock price.