Center of gravity indicator: Center of Gravity COG Charts Help and Tutorials

The indicator from 2002 was designed for trading on the reversals of the price. It helps to predict future movements and works best on ranging markets. Its efficiency drops significantly during the moments of the price trend. In opposition to such oscillators like Stochastic or RSI, the COG does not include oversold or overbought zones. Lagging indicators are those that observe the already-occurred price movements, therefore, their signals are generated after a certain move.

When the red signal line crosses below the zero line, the entry occurs on the open of the next candle. When the red signal line crosses above the zero line, the entry occurs on the open of the next candle. One of our heroes is none other than the man himself…John Ehlers. His distinguished titles are Chief Scientist and President of MESA Software, Inc., and is a technical analyst and Electrical Engineer, to boot.

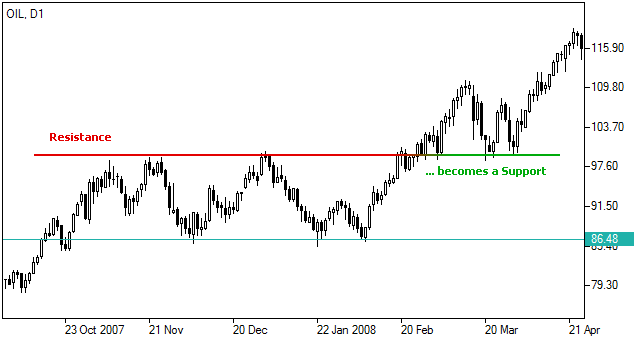

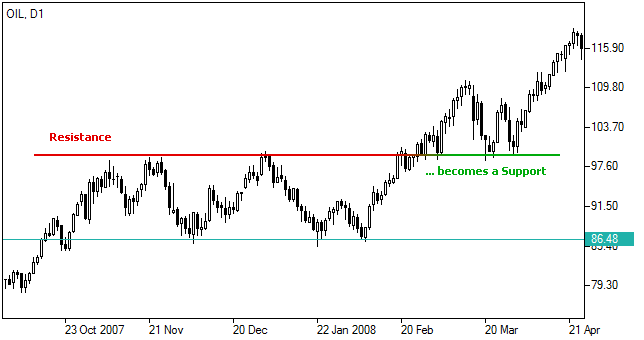

That’s because, during a trend, the price will likely continue in the same direction for a while, whereas the COD indicator is applied to quickly change prices. Unlike leading indicators, lagging indicators only assess the price movements that have already occurred. Therefore, traders use them in order to confirm a certain trend, which is also a very important factor in trading. Lagging indicators help improve market visualization and make chart information more easily digestible. When trading Forex, stocks, or other securities, locating support and resistance areas is one of the main objectives.

* Reduced lag creates a more responsive indicator.

I am talking about the ADX which stands for the Average Directional Movement Index. In the Center of gravity indicator, there are two red and green lines. The green line acts as a COC line, while the red line represents the signal line. These two conditions derive from the calculation of the COG Indicator, which has a complex formula to explain here. We only need to know that this indicator and the above-mentioned configurations only work if the market doesn’t have a definitive trend. First, you need to locate the actual download file on the internet.

That being said, the results we post in these blogs should never be considered specific trading advice. The reason exceptionally long testing periods are not included is due to changing market conditions, which might return irrelevant information. A balance of statistically significant data is necessary for accurate results. This lone variable tells the formula how many periods to take into consideration when calculating the signal line.

Chaikin Money Flow (CMF)

Our goal here is to determine how well the indicator reacts to price with respect to producing a long or short signal. Your system, with its risk profile, will dictate individual returns. On the EUR/USD, BTC/USD, XAU/USD, and the SPX500 using the default settings across the daily and 4-hour timeframes on the MT4 strategy tester. We use the fast method of testing the indicator to get a general idea; however, you may also run the tick-by-tick data set for a more precise result . Let’s take a look at a marked up chart to see what kind of signals were generated using the default settings. It can be combined with the ADX indicator to identify ranging market conditions and to exclude strong trends.

Finally, we explained how the COG indicator MT4 download is done and that it takes very few steps to have it on your platform. The Center of Gravity is a channel indicator of technical analysis. The CoG indicator is not included by default in most trading platforms.

COG indicator guide for traders – Key takeaways

Traders usually use them to confirm a trend and make trading decisions in the same direction of that trend. The Center Of Gravity is calculated from the sum of prices over a user defined period. A signal line which is an moving average of the COG is also plotted.

As the price has reached its peak, many traders want to start selling their assets, thus forming a resistance level to the uptrend. Using the CoG tool, you can build a unique trading system, since the price never moves in only one direction – it is cyclical and varies from its average values to extremes and vice versa. And it is these values that help to identify the considered indicator. Adjust the top and bottom guides to control the quantity and quality of the trading signals.

If the chart has crossed the blue line from bottom to top, then we can consider the option to buy, if from top to bottom, we may consider to sell. The green highlighted rows represent “basic tweaks” on the settings which returned better results. Given that variables including testing date range and broker data are different from person to person, you may find better settings.

According to John Ehlers, a creator of the Center of Gravity indicator, the COG has little to no lag at all. To understand this, you need to know what the difference between lagging and leading indicators is. We are going to explain a simple Center of Gravity trading strategy based on the centerline of the indicator. However, you can combine the indicator with other tools as well. Remember, comprehensive analysis is strongly suggested, and we advocate backwards and forward testing indicators or systems prior to trading actual funds.

It gives clear signals to enter buy or sell positions whenever the lines cross each other. Conversely, if the COG line crosses below the signal line, it means that the asset price has met resistance and started declining. One thing to keep in mind when using these COD indicator settings is that it works only if the market has no defined trend and the support and resistance levels interchange between each other.

Find the trend reversal points for buying and selling

As already mentioned earlier, the COG is a leading indicator, meaning it can help traders make some predictions about future price movements. Usually, COG indicators are plotted as oscillators in the chart, which means the indicator moves within a certain scale in order to give a buy or sell signal. Basically, it is just a question of adding the closing prices during n recent periods.

The COG gives a signal to buy when the indicator’s line crosses the SMA from below and continues above it. It will draw real-time zones that show you where the price is likely to test in the future. This method includes simple buying and selling based on the COC line and signal line crossover. The Center Of Gravity period can be adjusted directly from the keyboard without having to open up the preferences window.

This is where having a computer to calculate the indicator is key. We’ll give you the formula, but if you want to manually run numbers, we’ll be in the next room wishing you the best. You may want to use an extra indicator to identify a ranging market.