What Is a Moving Average?

A moving average is a forex indicator whose primary function is to smooth out price fluctuations. It assists in identifying trend reversals from the usual market “noise.” It is often identified as a trend-follower since it notes a currency pair’s past prices to assess the market.

“Moving average” refers to a security’s average closing price given with a particular period. Even if moving averages function independently, they can be paired up with other indicators to optimize their capability in interpreting the market.

Please note that this article will concentrate on “moving average” in general terms.

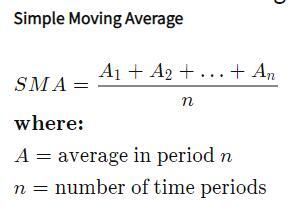

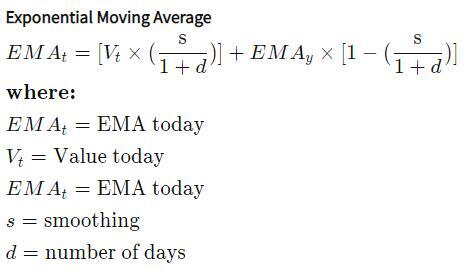

There are two kinds of moving averages, namely: simple moving average, which is the average of the prices on a given period; and exponential moving average, which concentrates on the security’s recent prices.

Moving Average Formula

Here’s how to solve SMA and EMA:

Understanding Moving Average

As mentioned, moving averages forecast security’s future prices. In doing so, it considers past prices, which means that it lags behind the security’s actual present price. Through evaluating how the moving average looks, the trader using this indicator can assess the future price. Note that many kinds of moving averages are employed and that these numerous moving averages have different levels of “smoothing out” the price behavior. This comes in handy for many forex traders.

Moving averages pinpoint trading signals by assessing the trend, which can help the trader interpret the market. A rising moving average implies an uptrend market. Meanwhile, a descending moving average implies downtrend.

During a crossover, momentum is confirmed. Once a long-term moving average is crossed above by a short-term moving average, it is an indication of upward momentum. Conversely, once the long-term moving average is crossed below by the short-term moving average, it indicates downward momentum.

Short-Term or Long-Term: Choosing Moving Average

This is an important aspect as it is sometimes the dealbreaker in many forex trades. A shorter period equals fewer data in the calculation; the moving average stays at a pace closer to the current price. A comparatively longer time frame means more data for the calculation, offering a more cohesive reading into the market. More data means less effect on the total average, even with price changes.

Traders can customize the period in their moving average, allowing them to utilize this indicator in accordance to their trading plan. The general idea is that the smoother the moving average, the slower it reacts to the price movement. The rougher it is, the quicker it responds to the price movement.

Moving averages lag since their calculations are based only on past prices. Consecutively, a longer time frame entails a bigger lag. Before you pick your moving average, consider the trading type you will use. If you opt for short-term trading, use a shorter moving average; if you choose for a long-term trade, then use a longer moving average.

If you opt for a short-term trade resulting in quick, small profits, then you would want to know only the most recent prices, which is why you should pick a shorter moving average. Meanwhile, if you want a long-term trade with slow, but higher profits, then pick a longer-term moving average since it takes a long list of past daily closing prices. In this way, you can predict the longer-term future prices of a security.

Lastly, forecasting future movement is a key factor in forex trading. It is not an easy and quick way, but forex indicators help you analyze the market. In this way, you can get the best out of your forex trading.