how to invest in mining stocks: Complete guide: How to invest in mining stocks New 2022

Research the company’s recent actions before making any decisions about buying or selling in reaction to sudden increases in stock price. The GDXJ is a junior gold miners ETF that tracks a market-cap-weighted index of global gold and silver mining companies. It is made up of 91 small and mid-cap mining companies who generate more than 50% of their revenue from gold or silver mining. It was created to allow investors to invest in a diversified group of junior mining companies.

![]()

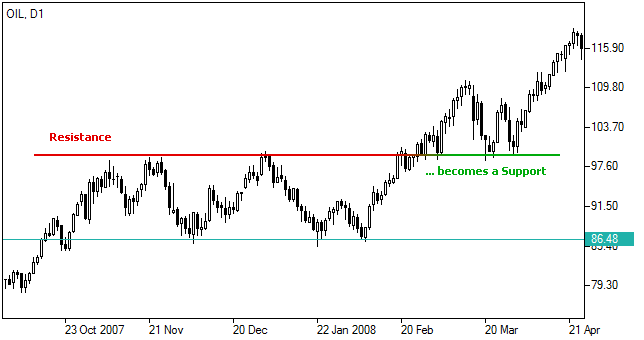

The two most watched indices of gold mining stocks are the NYSE Arca Gold BUGS Index and Philadelphia Gold and Silver Index . The chart below compares the historical performance of these indices against gold. Moreover, mining stocks usually offer leverage, as the commodities can be mined at prices lower than the spot price . Consciously assess the board and management team.Welook for a disciplined record in effective allocation of capital throughout the cycle combined with a track record of shareholder returns.

Top mining stocks to buy in 2023

The goal of most junior miners is to be acquired by a larger company. It’s become increasingly common for major and mid-tier mining companies to dedicate their extra cash to acquiring junior miners, rather than exploring for new deposits. The costs of building and operating a mine are so high that only mid-tiers and majors can sustain them. Good juniors will complete all the technical and logistical work required to get the mine into production, positioning themselves for acquisition. Look for juniors who are transparent about their data and financial status, and are open to working with partners.

A junior mining stock typically sees the most action leading up to, and immediately after, a feasibility study. If the study is positive, then the value of the company may shoot up. Often, a junior miner won’t mine a feasible deposit to the end.

The success of a mining company depends upon multiple variables including exploration results, jurisdiction and corporate structure. A well-funded and robust drill program allows the company to produce a maiden resource estimate. Poor exploration drilling results could mean that there is little/no resource in the location. Percussion rotary air blast drilling is the fastest and cheapest drilling method, ideal for drilling a large number of shallow holes across a deposit.

Make sure you understand and are comfortable with putting risk capital into junior miners, and remember to diversify. Monitor the stock prices of the individual junior mining companies you’ve invested in. When you see sudden changes in their stock price, read recent press releases and quarterly announcements to see what caused the change. If a company released excellent drill test results, a sharp increase in stock price is expected.

At the core of value investing is establishing the intrinsic value of a company share which may be very different from its market value. Value investors are seeking companies with share prices trading at steep discount to their intrinsic value. So you must also have the discipline to follow strict analytical guidelines in making decisions and the patience to wait for investment opportunities to arise. Demand for mined materials tends to fall when the economy slows down. That’s a concern for investors in 2022 given the worries that surging inflation will force central banks to raise interest rates, which could tip the global economy into a recession. Any person who commits capital with the expectation of financial returns is an investor.

Instead, save time, slay stress, and start investing with confidence by joining Opens today. Be clear about what your investing strategy is and be honest with yourself when assessing an investment. And in 2021, for a good night’s sleep, invest in stories with strong fundamentals, not momentum.

Should you buy mining stocks?

Finding a project with excellent deposit geology doesn’t guarantee that it will be a success. Jurisdictional problems can prevent projects from moving forward or even shutter them altogether. These risks include political instability, lack of infrastructure, lack of skilled workers, unfriendly economic policies towards foreign companies, and community problems.

If you’re considering investing in mining, you should pay attention to the amount of debt the mining company has. Mining companies with a lot of debt can struggle during economic downturns. On the other hand, mining companies that have low production costs and efficient operations can see significant profits during any economic period. Institutional investors are at an advantage compared to retail investors.

You can also invest in gold by trading options and futures contracts. You’ve done your research and chosen some promising junior miners to invest in – now what? They tend to be volatile, so investors who want to make a profit need to keep a close eye on them, make sure they have an exit plan in place for junior mining stocks. Build your own portfolio of junior mining stocks – this is a great place to use your risk capital. Work with a professional advisor who is experienced in the mining sector and can research individual companies.

This guide will teach you how to do your own due diligence, make smarter investment decisions and become an expert in junior mining stocks. Gold is a popular place for investors to stash their resources during times of economic uncertainty, which could drive up the price of gold. Higher gold prices could help Barrick, although it faces strong economic headwinds with rising labor and fuel costs. But the idiosyncratic gold market isn’t forgiving and takes a long time to learn. This makes gold ETFs and mutual funds the safest choice for most investors looking to add some of gold’s stability and sparkle to their portfolios.

Gold Stocks and Gold

We view mining as a valuable and potentially lucrative activity. Although BHP Group produces several commodities, it primarily aims to be a low-cost producer. It efficiently operates large resource-rich mines and uses technology such as autonomous vehicles to reduce costs. The mining company’s focus on minimizing expenses also helps to mute the impact of inflation.

Juniors are riskier ventures, most likely found in commodity exploration, such as oil, minerals, and natural gas. The coal producer provides coal of varying grades specifically for use in other industrial processes. While this still significantly impacts the planet, it’s better than the thermal coal used for electricity production.

Similarly, look for downward trends and sudden decreases in stock price. They could be reactions to unsustainably high stock prices, commodity prices, or overall market actions. Positive exploration results often cause a stock price to increase, but investors can react in unpredictable ways. Stocks can decrease after positive results if the results weren’t as good as investors were expecting.

It’s hard to know exactly when the peak will occur, but it is typically within a few days of the announcement that caused the price to increase. Stock prices will settle and eventually decrease if the discovery does not pan out. Before selling, consider the company’s history and how it got to this point.

Fund managers might make hasty decisions to get money to the company and tax benefits back to investors quickly. The most well-known junior mining ETF is the VanEck Vectors Junior Gold Miners ETF . Although the GDXJ is advertised as a junior miner ETF, it has very few true juniors. For example, demand for battery metals and uranium is projected to increase as the world seeks out clean energy sources. Ultimately though the risk is amplified by the fact that they are trying to find something that is buried deep underground. If the management team is lucky enough for all of the data to indicate a high likelihood of success underground, they will be able to secure financing.

Juniors offer the potential for a lot of appreciation, making them the ideal investment to fill your risk capital quota. Risk capital refers to the portion of an investment portfolio allocated to speculative or high-risk, high-reward investments. These investments typically have above-average returns if they succeed.

Best Mining Stocks To Buy Now

This strategy can pay off big if a junior miner’s discovery gets into production and they sell the project to a mid-tier or major. Investors in mining stocks should be keenly aware of both the mining industry’s cyclicality and its capital-intensive nature. The best mining companies have proven abilities to generate profit regardless of economic conditions.