how to trade etfs: Learn how to buy an ETF Vanguard

![]()

Whether you have a bullish or bearish view of an ETF price, you can speculate on either upwards or downward price movement. When you buy an options contract, you agree to a strike price at a premium or discount to the futures price. You profit from the trade if the futures price moves toward the strike price by the expiry date, but lose the premium if the futures price moves away from the strike price. Charles Schwab Investment Management, Inc. , is the investment advisor for Schwab ETFs.

As a result, the number of ETF shares is reduced through the process called redemption. In this example, the AP is buying stock on the open market worth $100 per share but getting shares of the ETF that are trading on the open market for $101 per share. This process is called creation and increases the number of ETF shares on the market. If everything else remains the same, then increasing the number of shares available on the market will reduce the price of the ETF and bring shares in line with the NAV of the fund.

Joint & individual accounts

Trading CFDs allows you to use leverage to amplify your exposure to the ETF, so you can open a bigger position with a smaller deposit. ETFs can make it easier for investors to construct their portfolios when starting out and rebalance over time. An investor can allocate a portion of their portfolio to a specific sector, such as technology or consumer staples, or to a specific asset class, like bonds or commodities.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. ETFs are also good tools for beginners to capitalize on seasonal trends. It refers to the fact that U.S. equities have historically underperformed over the six-month May-October period, compared with the November-April period. To understand how an ETF works, let’s walk through how one is created. New ETFs must be approved by the financial regulator in the market where they will be listed.

In most cases, both ETFs and mutual funds represent “baskets” of individual securities, for example stocks or bonds. An ETF’s price is determined by the value of the fund’s underlying assets, known as the net asset value , and not by the fund’s market price. NAV is calculated as the ETF asset value minus the ETF liability value, divided by the number of shares in circulation. This is why supply and demand for an asset or market, for example the FSTE 100, can also play a part in pricing. These investors then own a portion of an ETF, but do not have any rights to the underlying assets in the fund. Instead, ETFs track the value of the underlying, and provide investors with near-identical returns.

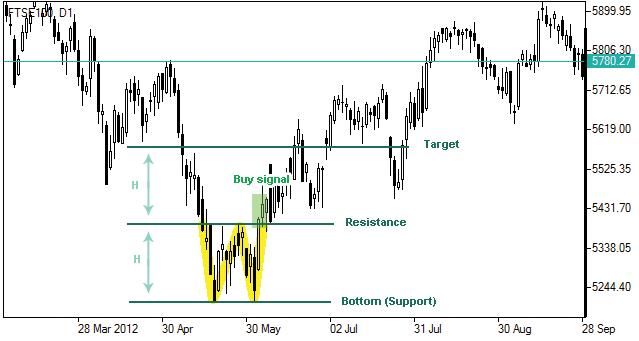

Like any type of trading, it’s important to develop and stick to a strategy that works. Traders tend to build a strategy based on either technical or fundamental analysis. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Fundamental analysis focuses on measuring an investment’s value based on economic, financial, and Federal Reserve data. Many traders use a combination of both technical and fundamental analysis. Nearly all ETFs provide diversification benefits relative to an individual stock purchase.

A key difference:

Matthew Frankel, CFP® has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF and Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF. The Motley Fool recommends Charles Schwab. Best ETFs to Buy ETFs can help eliminate risk because they tend to be less volatile than individual stocks. It can be extremely complicated to invest in individual bonds, but a bond ETF can make the fixed-income portion of your portfolio very easy. Not investment advice, or a recommendation of any security, strategy, or account type. Whether you’re new to investing, or an experienced trader exploring ETFs, the skills you need to potentially profit from ETF trading and investing should be continually developed.

Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. It’s important to keep in mind that ETFs are generally designed to be maintenance-free investments. How to Invest in Index Funds Index funds track a particular index and can be a good way to invest.

You can trade ETF CFDs along with CFDs of commodities, stocks and forex in the same account. ETFs offer investors a simple way to hedge their portfolios against downside risk. They are one of the easiest ways to invest in commodities like precious metals, which provide a hedge against economic uncertainty, rising inflation and low interest rates. For example, a trader expecting growth in emerging markets to slow down could short an emerging markets ETF. If an investor’s portfolio becomes overweight in a specific sector, they can sell some of their ETF holdings to invest in a different sector so the portfolio does not become overly concentrated.

Country ETFs track the primary stock indexes in foreign countries, but they are traded in the United States and denominated in U.S. dollars. Others track a wide breadth of foreign markets, such as ones that track emerging market economies and developed market economies . Some ETFs track an index of stocks, thus creating a broad portfolio, while others target specific industries. A leveraged ETF seeks to return some multiples (e.g., 2× or 3×) on the return of the underlying investments. For instance, if the S&P 500 rises 1%, a 2× leveraged S&P 500 ETF will return 2% (and if the index falls by 1%, the ETF would lose 2%).

Currency ETFs enable you to gain exposure to the forex market, without having to buy or sell the underlying currencies. In some cases, these ETFs will only track a single currency, but for the most part they track baskets of currencies. For example, physical replication makes it easier to see what you are invested in and is generally considered less risky than synthetic replication. However, there are some markets where physical replication is impossible or hugely inefficient. In which cases, synthetic replication provides exposure to markets that would be otherwise unavailable.

ETF share prices fluctuate all day as the ETF is bought and sold; this is different from mutual funds, which only trade once a day after the market closes. Commodity ETFs are often based on derivatives, rather than the physical asset, so can carry a higher risk. According to US investment company Blackrock, as of August 2022, there were more than 8,000 ETFs available globally. Investor demand and improvements in technology have made ETFs easy to invest in. Traded on stock exchanges, ETFs can be bought and sold instantly throughout a trading day, allowing investors to react quickly to any upcoming market trend.

ETFs at Charles Schwab & Co., Inc. (“Schwab”) which are U.S. exchange-listed can be traded without a commission on buy and sell transactions made online in a Schwab account. Trade orders placed through a broker will receive the negotiated broker-assisted rate. Please see the Charles Schwab Pricing Guide for additional information. For example, if you buy an S&P 500 ETF, your money will be invested in the 500 companies in that index. A fund manager will design an ETF to track the performance of an asset or group of assets, and then sell shares in that fund to investors. An index ETF is constructed in much the same way and will hold the stocks of an index, tracking it.

Expenses

Bond ETFs are more accessible to individual investors, as the bond market can be opaque with a variety of types of bonds, whereas ETFs offer immediate access to a portfolio of bonds. Bond ETFs pay out the interest they receive on the bonds in the portfolio. Investors can target their bond exposure, with short-term, intermediate-term and long-term ETFs. ETF trading is the buying and selling of exchange-traded funds to gain exposure to a broad range of assets and speculate on price fluctuations. This fee will vary, but typically is an asset-based fee of 0.10% per annum of the assets held at Schwab.

ETFs with Schwab

In addition, since ETFs are traded on an exchange like stocks, you can also take a “short” position with many of them . A short position allows you to sell an ETF you don’t actually own in order to profit from downward price movement. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. ETF providers make money mainly from the expense ratio of the funds they manage, as well as through transaction costs.

See theVanguard Brokerage Services commission and fee schedulesfor limits. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. , offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products.

Swing Trading

For example, commodity ETFs give access to oil, precious metals and agricultural markets. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker ($25) or by automated phone ($5). See theCharles Schwab Pricing Guidefor Individual Investors for full fee and commission schedules. Each ETF is usually focused on a specific sector, asset class, or category. ETFs can be used to help diversify your portfolio, or, for the active trader, they can be used to profit from price movements.

One thing to remember during the research process is that ETFs are unlike individual securities such as stocks or bonds. Their income distribution depends on the performance of underlying bonds. They might include government bonds, corporate bonds, and state and local bonds—called municipal bonds.

The price fluctuates throughout the day as buyers and sellers execute trades. If demand rises, the price will move higher, and if it falls, the price will decrease. ETFs trade on the stock market and are available throughout a trading session. Investors can buy the fund units, or shares, in the same way as they can buy shares in a company stock.

Instead of investing a set dollar amount, you choose how many shares you want to purchase. Because they trade like stocks, ETF prices continuously fluctuate throughout the trading day, and you can buy shares of ETFs whenever the stock market is open. ETFs are bought and sold on a stock exchange – in much the same way as stocks. They perform a similar function to indices, investment trusts and other exchange traded products.