market hours forex: Forex Market Hours Live Forex Market Clock & Session Times

During this period, there is an increase in trading volume, volatility, and liquidity. The forex market is available for trading 24 hours a day, five and one-half days per week. The Forex Market Time Converter displays “Open” or “Closed” in the Status column to indicate the current state of each global Market Center.

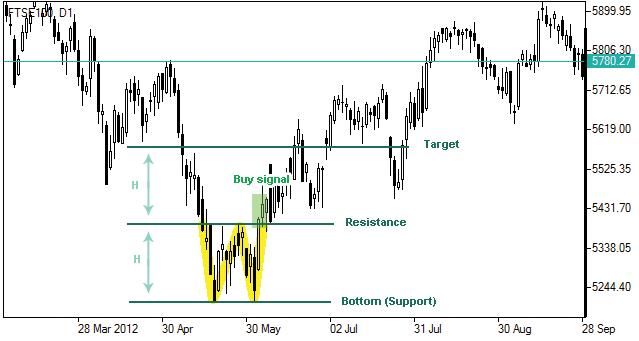

Also, dealing spreads are typically so wide that you would usually be wise to wait at least until the Tokyo opening to get a better idea of what the market is like. A sign for a potential breakout can be found using technical analysis or by anticipating or reacting to news. This is usually the case during the quiet Sydney and Tokyo session hours. Range Trading works best if a price is moving within relatively narrow ranges and is not breaking through the support or resistance levels.

What time zone do the Forex and Stock market use?

However, given the significant increase in trading volume at this time, it makes breakout trading much more lucrative. This is just a simple example, but this is the reason why often prices start to move, and trends are created. Consequently, the prices of these currencies will fluctuate more compared to outside of the banking hours. The most active times will occur when two or more trading sessions overlap and are open at the same time. During the weekdays, there’s always at least one forex trading session open although there are periods of downtime when the market is really quiet and trading volume is low or “thin”. Forex market hours are the schedule by which forex market participants can buy, sell, exchange, and speculate on currencies all around the world.

![]()

So, if you are trying to buy USD/JPY in the middle of the night when nobody in the United States or Japan are awake, then there is a good chance that you will have a hard time doing business. This is why in practice; you should spend your active trading hours when there are ample buyers and sellers in the market. Session times also vary according to daylight savings times in the relative regions – so the Sydney, London and New York forex session times are impacted by daylight savings, whereas Tokyo is not. And to make matters more complicated, the Sydney session is in the southern hemisphere, so their daylight savings season is opposite to that of London and New York.

How to use the Forex Market Time Zone Converter

You need to know when the forex market opens and closes as well as the four main trading sessions. And resumes trading again 48 hours later to begin a new week. When the market is open, traders all around the world can execute trades in the forex market, although trading conditions may vary. The highest trading volume occurs during the overlap of the London and New York trading sessions. More than 50% of trading volume occurs at these two financial centers.

Hedge funds with international exposure often buy and sell a large number of stocks across the globe to diversify their portfolios. Use the below Forex Market Clock to check where your current time is in relation to the 4 major forex trading sessions . Most of the trading activity for a specific currency pair will occur when the trading sessions of the individual currencies overlap. When two major financial centers are open, the number of traders actively buying and selling a given currency greatly increases. View the historical average of hourly trading volumes on the entire forex market. This will give you an idea of the times with the most liquidity and the smallest spreads.

After the open, traders may place new trades, and cancel or modify existing orders. A stop-loss order protects you from losing more than you are willing to risk. Before opening a trade you can specify a price level at which your position will be automatically closed. In the middle of the week, there is a tricky rollover commission that surprises many novice traders.

If you want to switch the time zone, use the search/dropdown menu in the top right corner. As we discussed earlier, when the market in New York opens, the London trading session has already progressed halfway for the day. As a result, the trading volume in the Forex market typically reaches the highest during the day at the opening hours of the New York trading session. The London session is responsible for around 30% of the trading volume, which is the highest among all major Forex market sessions around the world.

Brokers

However, traders should be aware that each trading session has its own unique characteristics and trading opportunities. The best time to trade stocks also depends on various factors such as market conditions, stock exchange location, and personal preferences. However, most traders consider the first two hours of the stock market opening as the best time to trade. During this time, there is usually an increase in volatility and trading volume. International currency markets are made up of banks, commercial companies, central banks, investment management firms, and hedge funds, as well as retail forex brokers and investors around the world. Because this market operates in multiple time zones, it can be accessed at any time except for the weekend break.

When trading volumes are heaviest, forex brokers will provide tighter spreads , which reduces transaction costs for traders. Likewise, institutional traders also favor times with higher trading volume, though they may accept wider spreads for the opportunity to trade as early as possible in reaction to new information they have. During these two hours, forex trading volumes can decrease to just 2% of peak turnover. Consequently, the spreads get very high and any transaction completed during that period can influence the market disproportionately. It is during this time that many stop-losses get triggered and flash crashes happen more frequently.

Some of the most active market times will occur when two or more Market Centers are open at the same time. The Forex Market Time Converter will clearly indicate when two or more markets are open by displaying multiple green “Open” indicators in the Status column. Just because you can trade the market any time of the day or night doesn’t necessarily mean that you should. Overnight trading refers to trades that are placed after an exchange’s close and before its open. The foreign exchange, or Forex, is a decentralized marketplace for the trading of the world’s currencies. The benchmark spot foreign exchange rate, used for daily valuation and pricing for many money managers and pension funds, is set at 4 p.m.

Trading Schedule – Good Friday – April 2023

Dollars to get some British Pound for pocket money at an Airport Foreign Exchange Kiosk after arriving in London, in the middle of the night, it would be also considered as a foreign exchange trade. However, as you can guess by now, large billion-dollar, cross-border, transactions do not happen at 3 a.m. The forex market is where banks, funds, and individuals can buy or sell currencies for hedging and speculation.

Two open markets at once can easily push the movement to more than 70 pips, especially when big news are released. During periods of reduced liquidity, currency rates are subject to more sudden and volatile price movements. You can also select the GMT option to check current GMT time in relation to the sessions. Head over to our Trading Academy to learn everything you need to know about the financial markets. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. Before trading, it is wise to check the rollover terms of your chosen broker.

We will keep this information up-to-date as much as possible. Please be advised that in times of public holiday, there may be periods of limited liquidity in some markets. You usually want to avoid trading when only one trading session is open and instead, wait for trading sessions to overlap. The more traders…trading, the higher the trading volume, and the more active the market. Trading volume varies from one session to another, although the highest trading volume tends to occur when the London and New York sessions overlap. Trades and orders held over the weekend are subject to execution at the next available market price based on available liquidity.

The period when these two trading sessions overlap is the busiest period and accounts for the majority of volume traded in the day, with trillions of dollars in value changing hands. Check when the forex market opens and closes in London, New York, Sydney, Tokyo. Unlike with other tools – national bank holidays and weekends are taken into account. Hence, knowing which time of the day the Forex market remains most active is an integral part of becoming a successful trader.

The forex market is open 24 hours a day during weekdays but closes on weekends. Breakout traders are the ones who can benefit from volatile markets, so the best time for breakout trading is during the famous London/New York overlap, and also during the opening hours of the London session. It is important to remember that each of the forex session times are approximations as to when trading activity picks up and is influenced by the relative region/session. Globally, forex session times are a general indication not hard fixed times – they are influenced by many factors, including when local business’ open and close.

The best time for range traders to trade is during the Asian session. The third one did not take the daylight savings transitions into account… Moreover, most of them did not show up-to-date holidays when the markets are closed or have little activity. A currency pair has a high level of liquidity when it is easily bought or sold and there is a significant amount of trading activity for that pair. While most brokers suspend trading during the weekend, the fact is that economic news and geopolitical events still occur on Saturdays and Sundays. As a result, the valuation of different currency pairs can change after the brokers suspend trading on Friday. To buy something you need someone else to sell you want you are trying to buy and vice versa.

Hence, often major trends start and end during the London Forex market hours. While the actual trading strategy you have may not change, knowing when to trade can certainly help you stop wasting time looking for trades when are no trading opportunities in the market. Furthermore, success in Forex trading in highly depends on timing, as trends can often reverse and wipe out the profits in your open trades. The FX market is open 24 hours a day from Monday to Friday – as one part of the world goes to sleep, another wakes up. That’s why we talk about Forex market hours and Forex trading sessions – to describe where and when the different Forex trading sessions are open to trading. The stock market, on the other hand, typically operates according to the time zone where the exchange is located.